THE Tax Question: Standard or Itemize

- Jeremy Springer

- Dec 29, 2025

- 4 min read

Do you think that you need to track all of your expenses each year so your tax preparer can help you itemize your deductible costs in your tax personal tax return? Has your trusted tax preparer every said: "You're taking the standard deduction this year as it helped you more." In this helpful info article, we're talk the difference between standard deduction and itemized deduction for your personal tax return (Form 1040).

Standard Deduction

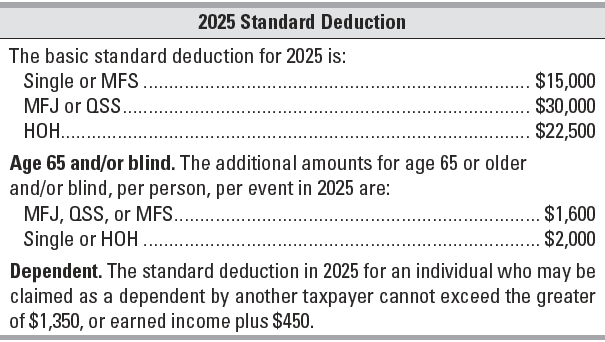

The standard deduction reduces taxable income. It is a benefit that eliminates the need for many taxpayers to itemize actual deductions, such as medical expenses, taxes, interest, and charitable contributions, on Schedule A (Form 1040). The standard deduction is increased by an additional amount for taxpayers who are age 65 or older, or are blind.

Itemized Deductions

You must decide whether to itemize deductions or to use the standard deduction. Generally, you should itemize deductions if the allowable itemized deductions are greater than the standard deduction. Some taxpayers must itemize deductions because they cannot use the standard deduction.

The standard deduction cannot be used if you are:

Married filing as Married Filing Separately, and your spouse itemizes deductions.

A nonresident alien or a dual-status alien during the year.

You may benefit from itemizing deductions on Schedule A (Form 1040), Itemized Deductions, if you:

Cannot use the standard deduction.

Had large unreimbursed medical and dental expenses.

Paid interest or taxes on a home.

Had large uninsured casualty or theft losses resulting from a presidentially-declared disaster area, or

Made large charitable contributions.

Itemized Deductions Limitations

You may be subject to limitations on some itemized deductions.

Medical and dental expenses. Qualified medical and dental expenses are deductible as itemized deductions to the extent they exceed 7.5% of adjusted gross income (AGI). For example, for an individual with an AGI of $50,000, only those expenses that exceed $3,750 (7.5% of $50,000) would be deductible.

Taxes paid. Deductible state and local income, property, and sales taxes are limited to a total amount of $10,000 ($5,000 Married Filing Separately). No deduction is allowed for foreign real property taxes.

Interest paid. Deductible home mortgage interest is limited to total acquisition debt incurred after December 15, 2017, on a main and second home combined to $750,000 ($375,000 Married Filing Separately). Acquisition debt before December 16, 2017, is limited to $1 million ($500,000 for Married Filing Separately). Interest on home equity debt is not deductible unless used to buy, build, or substantially improve a qualified home.

Charitable contributions. Your deductible charitable cash contributions are limited to 60% of AGI. Any amount over the limit can be carried forward up to the next five years. No charitable deduction is allowed for payments to higher education institutions in exchange for the right to purchase tickets or seating at an athletic event. No charitable deduction is allowed for contributions of $250 or more without substantiation.

Casualty and theft losses. A personal casualty or theft loss is deductible (subject to limitations) only if such loss is attributable to a federally-declared disaster.

Gambling losses. Gambling losses (cost of non-winning bingo, lottery, and raffle tickets, for example) are deductible only to the extent of gambling winnings reported as Other Income on Schedule 1 (Form 1040), Additional Income and Adjustments to Income.

Other itemized deductions. Other itemized deductions include:

Amortizable premium on certain taxable bonds acquired before 1988.

Casualty and theft losses from income producing property.

Federal estate tax on income in respect of decedent.

Impairment related work expenses for persons with disabilities.

Losses from Ponzi type investment schemes.

Repayments of more than $3,000 under a claim of right.

Certain unrecovered investment in a pension.

In addition, if you have a net qualified disaster loss, and are not itemizing deductions, you can claim an increased standard deduction.

Expenses Not Deductible as Itemized Deductions

Certain expenses are not deductible as itemized deductions, including all miscellaneous itemized deductions previously subject to the 2% AGI limitation.

Job Expense & Certain Miscellaneous Deductions*

Unreimbursed employee business expenses.

Tax preparation fees.

Certain legal and accounting fees.

Clerical help and office rent.

Custodial (for example, trust account) fees.

Investment expenses of a regulated investment company (RIC).

Deduction for repayment under a claim of right if $3,000 or less.

Investment expenses.

Safe deposit box fees.

*Currently nondeductible

Other Nondeductible Expenses

Political contributions.

Legal expenses for personal matters that do not produce taxable

income.

Lost or misplaced cash or property.

Expenses for meals during regular or extra work hours.

The cost of entertaining friends.

Commuting expenses.

Travel expenses for employment away from home.

Travel as a form of education.

Expenses of attending a seminar, convention, or similar meeting.

Club dues.

Expenses of adopting a child. But you may be able to take a credit for

adoption expenses.

Fines and penalties.

Expenses of producing tax-exempt income.

To Itemize or Not

You may decide to take the standard deduction even if your itemized deductions are higher. Conversely, you may choose to take itemized deductions in a lesser amount than the standard deduction.

Example 1

David, 45, is single, has AGI of $100,000, and has the following itemized deductions:

Medical expenses............................................................ $8,200

Less 7.5% of AGI threshold......................................... ($7,500)

Deductible medical expenses.............................................$700

State and local income tax.............................................. $4,925

Real estate tax................................................................... $3,225

Mortgage interest paid..................................................... $5,425

Noncash charitable contributions...................................... $800

Total itemized deductions...............................................$15,075

Even though his itemized deductions are greater than the standard deduction by $75 ($15,075 minus $15,000), David chooses to take the standard deduction because he was not able to locate receipts to substantiate all of his charitable contributions.

Example 2

Assume the same facts as Example 1, however David has no charitable contributions. His total itemized deductions are now $725 less than the standard deduction ($15,075 minus $800 charitable contribution equals $14,275. David’s standard deduction is $15,000). David chooses to file with the lower itemized deductions because the tax benefit of itemizing on his state return is greater than the tax benefit he loses on the federal return by not taking the standard deduction.

Legal Disclaimer: This post contains general information for taxpayers and should not be relied upon as the only source of authority. Taxpayers should seek professional tax advice for more information. This information was current at time of posting; we are not responsible for updating this or any blog post/article for subsequent changes in the law or its interpretation.

Certain content on this page is copyright © 2025 Tax Materials, Inc. All Rights Reserved for applicable content. Used with permission.

.png)